Weekly Market Insights – 2 February 2026

US Fed kept rates at 3.50%-3.75%, with Powell calling policy appropriate amid solid growth; Trump nominated Kevin Warsh to replace him as chair in May. US consumer confidence hit a 10-year low (84.5), but PPI rose sharply, layoffs stayed low, and earnings remained healthy. Eurozone GDP grew 0.3% qoq in Q4 (1.5% for 2025), led by Spain/Italy, while China set cautious 2026 provincial targets.

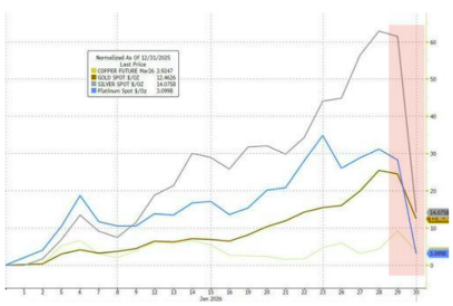

Global equities advanced, with EM (+1.8%) outpacing developed (+0.5%); S&P 500 topped 7,000, US value/defensives led, Communication Services & Energy surged. Stoxx 600 edged up, Japan/China were flat to lower. Dollar weakened (-0.6%), yields rose modestly, and gold/silver spiked to records before sharp sell-off post-Warsh news.

Download the full report below for detailed analysis, market data, and our assessment of the implications for global investors.

Report

Weekly Market Insights

2 February 2026

Charts of The Week