Monthly Market Insights – January 2026

Global markets faced resilient growth tempered by moderating inflation, diverging central bank policies, and ongoing geopolitical strains. The IMF sees steady expansion into 2026, driven by technology and fiscal support despite trade frictions, while key economies showed durable consumer and policy backing.

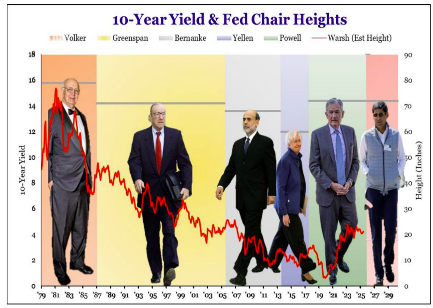

Central banks moved cautiously: the Fed held steady with inflation still elevated, the ECB remained accommodative, the BoE eased rates amid fragile UK conditions, and Japan paused hikes as price pressures cooled. Trump’s choice of Kevin Warsh to lead the Fed sparked debate over its independence.

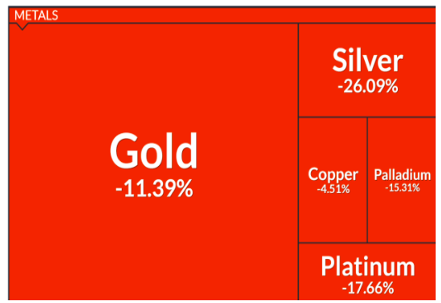

Markets opened the year strongly, led by emerging equities, commodities, and selective fixed income. Rotation favored value and defensives in the US and Europe, Asian tech surged, precious metals advanced despite volatility, the dollar softened, and cryptocurrencies trailed.

Download the full report below for detailed analysis, market data, and our assessment of the implications for global investors.

Report

Monthly Market Insights

January 2026

Charts of The Month

Source: Syz, ZeroHedge